Title loans for luxury vehicles have gained popularity as a quick and accessible financial solution, allowing car owners to borrow against their high-end cars or motorcycles using the vehicle's title as collateral. Offered by lenders like Dallas Title Loans, these short-term loans provide immediate cash but come with high interest rates and repossession risks if not repaid promptly. While appealing for unexpected expenses, exploring alternative emergency funding sources may offer better long-term financial stability.

“Uncover the reality behind title loans for luxury vehicles – a financial solution that has both avid advocates and cautious critics. This comprehensive guide delves into the intricacies of this alternative financing method, offering a clear understanding of how it works and who it benefits. Through real-life use cases, we explore the stories of individuals navigating success and challenges. By weighing the pros and cons, you’ll gain insights to make informed decisions regarding title loans for luxury vehicles.”

- Understanding Title Loans for Luxury Vehicles: A Comprehensive Guide

- Real-Life Use Cases: Stories of Success and Challenges

- The Pros and Cons: Weighing the Options Before You Borrow

Understanding Title Loans for Luxury Vehicles: A Comprehensive Guide

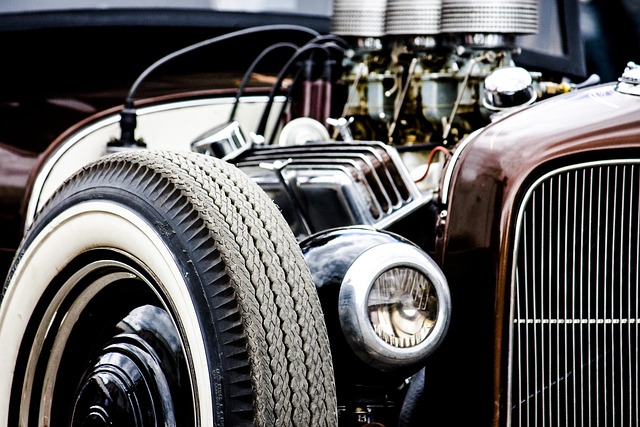

Title loans for luxury vehicles have gained popularity as a unique financial solution for car owners looking to access immediate cash. This alternative lending option allows individuals to borrow funds using their high-end vehicle’s title as collateral, offering a quick and convenient way to secure capital. It’s particularly appealing to those in need of emergency funding or those seeking a fast way to raise money without traditional banking channels.

In this comprehensive guide, we’ll explore the mechanics behind these loans. When you apply for a title loan for your luxury vehicle, lenders assess the car’s value and offer a percentage of its total worth as a loan. The process is often straightforward, with minimal documentation required, unlike conventional loans. Additionally, motorcycle title loans are another form of secured lending that operates similarly, providing riders with a financial safety net. Dallas Title Loans, for instance, has become a go-to option for locals seeking quick cash, demonstrating the growing trend and accessibility of such financial solutions.

Real-Life Use Cases: Stories of Success and Challenges

In the realm of financial solutions, title loans for luxury vehicles have emerged as a unique and often life-changing option for car owners. These loans provide an alternative source of capital, allowing individuals to access significant funds by leveraging their high-end automobiles. Real-life use cases reveal diverse stories of success and challenges.

For instance, many borrowers opt for title loans when facing unexpected financial crises, such as medical emergencies or home repairs. The quick funding associated with these loans enables them to cover immediate expenses without selling their beloved luxury vehicles. Others use the cash advance to invest in business opportunities or education, potentially paving the way for a brighter future. However, challenges also arise; some borrowers struggle to repay the loans on time, leading to repossession concerns. Therefore, it’s crucial to understand the terms and conditions thoroughly before taking advantage of these financial tools, ensuring a positive outcome like keeping your vehicle while benefitting from much-needed funds.

The Pros and Cons: Weighing the Options Before You Borrow

When considering title loans for luxury vehicles, it’s crucial to weigh both the advantages and disadvantages before making a decision. These short-term, high-interest loans can offer quick access to cash, especially when emergency funds are low, as is often the case with luxury car owners who typically have higher maintenance costs. In Dallas, where title loan services are readily available, the title loan process is straightforward, requiring only your vehicle’s title and a few basic documents. This makes it an attractive option for those in need of rapid financial relief to avoid repossession or cover unexpected expenses.

However, the cons cannot be overlooked. The primary drawback lies in the high-interest rates associated with such loans, which can quickly compound and result in substantial repayment amounts. Furthermore, if you default on the loan, your vehicle may be at risk of repossession, leaving you without transportation. Thus, it’s essential to carefully consider whether a title loan for luxury vehicles is the best financial move, especially when exploring alternative emergency funding sources might prove more beneficial in the long run.