Title loans for luxury vehicles offer a quick financial solution, allowing owners to access cash using their car's title. With competitive rates and flexible terms, these loans enable owners to preserve their high-end assets while securing funding. The process is simple: assess vehicle equity, research lenders, compare offers, review agreements, and secure approval for same-day funds.

Title loans for luxury vehicles offer a unique financing solution for car enthusiasts. In this article, we explore how these specialized loans can provide access to capital while keeping rates low. We delve into the process, from understanding the concept of title loans to navigating the step-by-step guide. By unlocking your vehicle’s equity, you can gain financial flexibility and enjoy your luxury asset without compromising on quality.

- Understanding Title Loans for Luxury Vehicles

- Low-Rate Options: Unlocking Access to Your Asset

- Navigating the Process: A Step-by-Step Guide

Understanding Title Loans for Luxury Vehicles

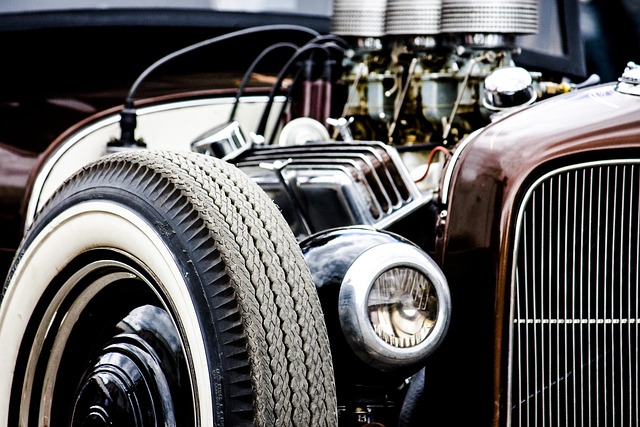

Title loans for luxury vehicles have gained popularity as a financial solution for car owners looking to access quick cash while retaining their high-end assets. This type of loan is secured by the vehicle’s title, allowing lenders to offer competitive interest rates and flexible repayment terms. When you take out a title loan on your luxury vehicle, the lender conducts an assessment to determine its market value, ensuring that the loan amount aligns with the car’s worth.

The process involves applying for a loan online or at a physical location, providing necessary documentation, and undergoing a quick approval procedure. Upon approval, you can receive same-day funding, making it an attractive option for those in need of immediate financial support. This alternative financing method is particularly appealing to luxury vehicle owners who value their assets but require access to cash quickly without compromising on interest rates.

Low-Rate Options: Unlocking Access to Your Asset

When it comes to securing funds for your luxurious rides, Title Loans for Luxury Vehicles offer a unique and accessible solution. One of the key advantages is the low-rate financing options available, allowing owners to unlock the equity tied up in their assets. This alternative lending method provides an efficient way to gain fast cash without sacrificing the value of your prized possession.

The process is streamlined, especially with the convenience of an online application. Borrowers can submit their requests from the comfort of their homes, making it ideal for busy individuals who own high-end vehicles like semi trucks or exotic cars. This modern approach ensures a swift response, catering to those in need of immediate financial support while preserving the integrity of their luxurious vehicle ownership experience.

Navigating the Process: A Step-by-Step Guide

Navigating the Process: A Step-by-Step Guide to Title Loans for Luxury Vehicles

The process of obtaining a title loan for your luxury vehicle can seem daunting, but with a clear understanding of each step, it becomes more manageable. Initially, you’ll need to determine your vehicle’s equity, which is calculated based on its current market value and any outstanding loans or leasings. This is crucial as it dictates the loan amount you’re eligible for. Once you have this information, you can start shopping around for lenders who offer competitive rates, especially those specializing in luxury vehicles.

When comparing offers, ensure you understand all loan requirements and terms to find the best fit. Reputable lenders will consider factors like your credit history (even if you have bad credit loans) and income to assess repayment capability. After selecting a lender, they’ll provide a detailed agreement outlining the interest rate, loan term, and repayment schedule. It’s essential to read and understand this document before signing, ensuring transparency throughout the process.

Title loans for luxury vehicles offer a unique solution for car owners looking to unlock immediate cash while keeping their prized possessions. By leveraging the value of your high-end vehicle, these low-rate financing options provide access to capital with minimal hassle. Through a straightforward process, you can tap into the equity of your asset and enjoy both financial flexibility and continued ownership. This alternative financing method is particularly appealing for those in need of quick funds without sacrificing their beloved luxury vehicles.