Title loans for luxury vehicles provide swift, collateralized funding for car owners, bypassing extensive paperwork and credit checks. This option is popular in cities with a thriving luxury market, catering to diverse financial needs. With flexible terms, individuals can access emergency funds without sacrificing their high-end assets.

Looking to purchase or upgrade your dream luxury vehicle but need quick funding? Title loans for luxury vehicles offer a streamlined solution. This alternative financing method allows high-end vehicle owners to access substantial cash without the traditional credit checks. By leveraging the value of your car’s title, you can unlock its potential and gain immediate financial flexibility. Dive into this guide to explore the advantages and learn how these loans can empower your luxury automotive experience.

- Streamlining Luxury: How Title Loans Work

- Advantages for High-End Vehicle Owners

- Quick Cash Access: Unlocking Luxury Potential

Streamlining Luxury: How Title Loans Work

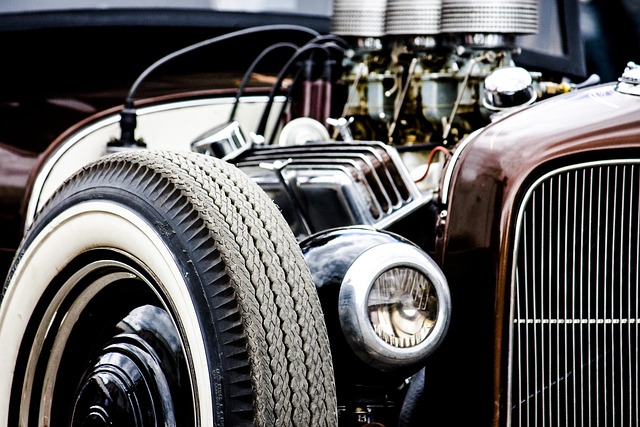

Title loans for luxury vehicles offer a streamlined solution for car owners looking to access immediate funding. This alternative financing method leverages the equity in your high-end vehicle, allowing you to borrow money against its value. The process is simple and efficient, often involving less paperwork and quicker approval times compared to traditional loans. After successful approval, lenders transfer the title temporarily as collateral until the loan is repaid. This means you can continue driving your luxury vehicle without any disruptions while enjoying the financial flexibility it provides.

For instance, in cities like Houston or San Antonio, where the market for luxury vehicles is thriving, title loans have become a popular choice. Houston title loans and San Antonio loans cater to diverse needs, ensuring that car enthusiasts and business owners alike can secure funding efficiently. By tapping into your vehicle’s equity, you gain access to immediate capital, enabling you to fund unexpected expenses or even upgrade to a new model without selling your prized possession.

Advantages for High-End Vehicle Owners

High-end vehicle owners often face unique financial challenges when it comes to maintaining and upgrading their prized possessions. Title loans for luxury vehicles offer a solution that caters specifically to their needs, providing several advantages. One significant benefit is the convenience of a quick and straightforward funding process. Unlike traditional loans that require extensive documentation and credit checks, title loans rely on the vehicle’s title as collateral, allowing owners to secure funds in a fraction of the time.

Additionally, these loans are particularly appealing for luxury vehicle owners dealing with unexpected expenses or who require emergency funds without compromising their asset. The flexibility of using the loan proceeds for various purposes—from repairs and upgrades to unforeseen financial commitments—makes it an attractive option. Moreover, individuals with bad credit can still apply, as the loan is secured against the vehicle’s value rather than the borrower’s credit history, providing access to much-needed capital.

Quick Cash Access: Unlocking Luxury Potential

One of the primary advantages of leveraging title loans for luxury vehicles is the swift access to cash it offers. When you own a high-end car, its value can serve as collateral, enabling you to secure a loan with relatively faster processing times compared to traditional financing options. This quick infusion of funds can be a game-changer during emergencies or unexpected financial constraints. Whether it’s an urgent repair, a sudden medical expense, or the need for emergency funding, title loans provide a convenient and efficient solution without lengthy application processes or stringent credit checks.

Additionally, these loans offer flexibility in terms of repayment. Borrowers can choose to pay off the loan swiftly to regain ownership of their vehicle or opt for loan extension options if unforeseen circumstances arise. This adaptability ensures that you maintain control over your luxury asset while accessing immediate financial support, thus unlocking the full potential and enjoyment of your prized possession.

Title loans for luxury vehicles offer a unique and convenient solution for owners seeking quick cash. By leveraging the value of their high-end assets, these loans provide access to immediate funds without the traditional long application processes. This streamlined approach allows vehicle owners to unlock the potential of their luxury rides, covering unexpected expenses or simply enjoying the financial freedom to upgrade their driving experience.