Title loans for luxury vehicles provide swift financial aid by using your vehicle's title as collateral, offering immediate approval, flexible repayment, and accommodating less-than-perfect credit. This alternative financing method is ideal for emergencies or upgrades, ensuring car owners maintain possession while accessing cash quickly with minimal hassle.

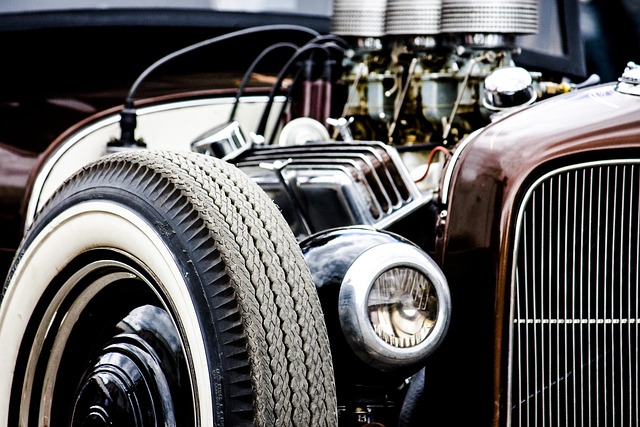

Looking to purchase or maintain a luxury vehicle but need quick funding? Title loans offer a streamlined, fast-track solution. This alternative financing method allows you to leverage the equity in your prestige car without the rigorous processes of traditional loans. With title loans for luxury vehicles, you gain access to cash promptly, enabling you to cover unexpected expenses or upgrade your ride with ease. This secured loan option provides peace of mind, as it poses less risk to lenders and can help preserve your high-end asset’s value.

- Streamlining Luxury: How Title Loans Work

- Fast Access to Cash for Your Prestige Vehicle

- Risk Mitigation: Secured Loans for High-End Cars

Streamlining Luxury: How Title Loans Work

Title loans for luxury vehicles offer a streamlined solution for owners looking to access immediate funds. This type of loan is secured by the vehicle’s title, allowing lenders to provide quick approval and disbursement. The process is straightforward; borrowers submit their vehicle’s title and application, and if approved, they receive a lump sum. Unlike traditional loans that may require extensive documentation and a lengthy application process, title loans for luxury vehicles focus on the asset itself, making it an attractive option for those in need of fast cash.

With flexible repayment options available, borrowers can tailor their payments to fit their budget. This flexibility is particularly beneficial for luxury vehicle owners who may have varying income patterns or unexpected expenses. Additionally, loan eligibility isn’t solely based on credit scores; lenders consider the overall value and condition of the vehicle, ensuring that even those with less-than-perfect credit can access funding. Whether it’s for an emergency expense or a desired upgrade, title loans provide a convenient and efficient way to tap into the equity of your luxury vehicle without the usual hassle.

Fast Access to Cash for Your Prestige Vehicle

When it comes to owning a luxury vehicle, unexpected expenses can throw off your financial plans. This is where title loans for luxury vehicles step in as a convenient solution. Unlike traditional loan options that often involve lengthy applications and strict credit requirements, Houston title loans provide fast access to cash with minimal hassle. The process is straightforward; you use your prestige vehicle’s title as collateral, allowing for a quick approval and immediate funding. No need to worry about credit checks or extensive paperwork—it’s an efficient way to get the funds you need without delay.

This rapid cash infusion enables car owners to cover various expenses, such as unexpected repair costs, urgent travel needs, or even paying off an existing loan. With a title loan, you can retain ownership of your luxury vehicle while accessing the equity built into its value. It’s a practical option for those seeking a quick and reliable source of funds without sacrificing their prized possession.

Risk Mitigation: Secured Loans for High-End Cars

One of the primary advantages of title loans for luxury vehicles is the risk mitigation they offer. Unlike traditional unsecured loans, these loans are secured by the high-end car itself, providing a safety net for both lenders and borrowers. This means if you’re unable to make payments as agreed, the lender has the legal right to repossess your vehicle. However, this also ensures that borrowers have a clear path to financial assistance without risking their most valuable assets.

The repayment options associated with title loans are designed to be flexible, catering to various financial scenarios. Borrowing against your luxury vehicle allows you to access fast cash when needed, which can help manage unexpected expenses or emergencies. This financial flexibility is particularly appealing for car enthusiasts who want to maintain their luxurious possessions without sacrificing their financial stability.

Title loans for luxury vehicles offer a convenient and secure financing option for car owners looking to access cash quickly. By leveraging the equity in their high-end vehicles, borrowers can enjoy fast approval and same-day funding, all while maintaining ownership of their prized possessions. This streamlined process is particularly beneficial for those who need liquid funds without sacrificing their luxurious assets. Moreover, since these loans are secured, they come with lower interest rates and flexible repayment terms, making them a smart choice for responsible borrowing.