Title loans for luxury vehicles offer flexible, high-value financing for car owners, bypassing traditional credit checks. After assessing your vehicle's worth, lenders provide a lump sum suitable for debt consolidation or upgrades. With no additional collateral needed and adaptable repayment terms, these loans cater to individuals with less-than-perfect credit. Reputable lenders specializing in high-end cars can be found through online directories, focusing on transparent terms, competitive rates, and secure processes.

Looking for a quick and secure loan against your luxury vehicle? Discover the power of Title Loans for Luxury Vehicles. This comprehensive guide breaks down the benefits, process, and tips for finding trusted lenders in your area. Secure funding without selling your prized possession—a hassle-free solution for those who appreciate both style and financial flexibility. Learn how title loans can offer fast access to cash while maintaining ownership.

- Understanding Title Loans for Luxury Vehicles

- Benefits and How It Works

- Finding the Right Lender Near You

Understanding Title Loans for Luxury Vehicles

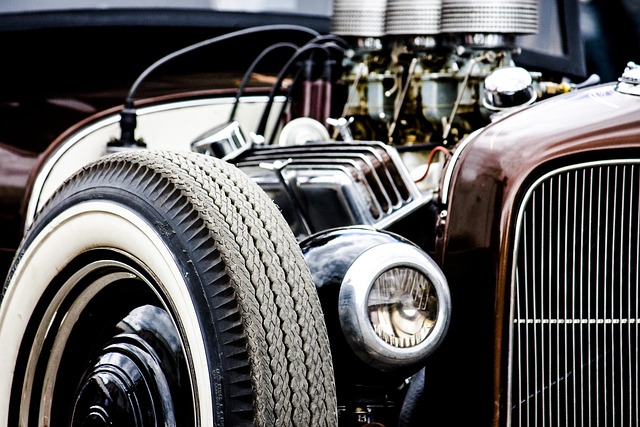

Title loans for luxury vehicles have gained popularity as a unique way to access financial assistance for high-end automobile owners. This type of loan is secured against the vehicle’s title, allowing lenders to offer relatively higher amounts compared to traditional personal or auto loans. The process involves a quick assessment of your vehicle’s value, and if approved, you receive a lump sum that can be used for various purposes. One of the main advantages is its flexibility; you can choose how to utilize the funds, whether it’s for debt consolidation, boat title loans, or even upgrading your luxury vehicle.

Unlike other loan options, title loans provide an opportunity for individuals with less-than-perfect credit to access capital. The primary focus is on the vehicle’s worth rather than the borrower’s financial history. This makes it a viable option for those seeking fast financial help without the stringent requirements of conventional loans. Moreover, since the loan is secured against the vehicle title, there’s no need for collateral beyond the car, making it an attractive choice for luxury vehicle owners in need of immediate financial assistance.

Benefits and How It Works

Title loans for luxury vehicles offer a unique financial solution for car owners looking to access immediate cash while keeping their high-end vehicle as collateral. This alternative financing method is particularly beneficial for those in need of quick funds, whether it’s for an emergency expense or a desired upgrade. The process begins with a simple application where lenders assess the vehicle’s value through a thorough inspection and appraisal. Once approved, borrowers can secure a loan based on their car’s worth, receiving funds relatively faster compared to traditional loans.

The flexibility of these loans lies in the various repayment options available. Borrowers can choose from different loan terms catering to their financial comfort, ranging from shorter to longer repayment periods. This adaptability ensures individuals can manage their finances effectively while enjoying the convenience of keeping their luxurious vehicle. Moreover, the vehicle valuation process guarantees borrowers receive a fair and transparent offer, allowing them to make informed decisions regarding their assets.

Finding the Right Lender Near You

When considering a title loan for your luxury vehicle, finding the right lender near you is crucial. Start by researching local options that specialize in title loans for high-end cars. Online directories and search engines can help identify reputable lenders with positive customer reviews. Look for institutions offering transparent terms, competitive interest rates, and flexible repayment plans tailored to your needs.

Ensure the lender provides a secure loan process with minimal hassle. Many reputable companies now offer fast cash through digital applications, allowing you to borrow against the equity of your luxury vehicle without the traditional credit check. This option is ideal for those seeking debt consolidation or quick funding. Remember to compare offers and choose a lender that aligns with your financial goals while prioritizing fair practices.

Secure a title loan for your luxury vehicle near you with confidence. Understanding these loans, their benefits, and how they work empowers you to make informed decisions. By choosing a reputable lender from your area, you can access quick cash while maintaining the value of your prized possession. Title loans for luxury vehicles offer a convenient solution for funding your passions.